From electric and connected vehicles to autonomous driving and 5G enabled smart mobility applications, the automotive industry is undergoing major transformations. Fueled by digital innovation and new network technologies, its value chain is increasingly data-driven as modern cars embark on more connected services, pushing OEMs to reinvent themselves and become service providers rather than traditional manufacturers.

Who controls the car connectivity and the associated services and value becomes a burning issue for the automotive ecosystem.

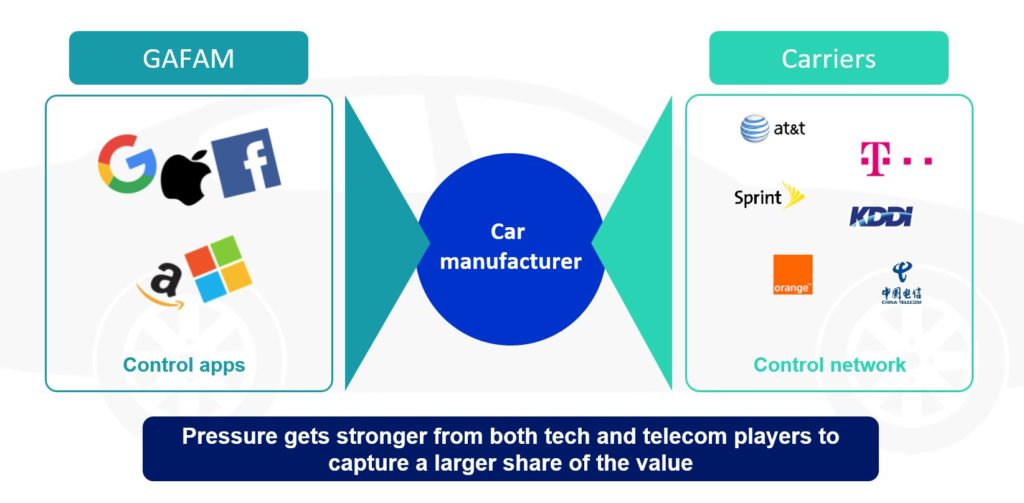

As new mobility models emerge, the main differentiation factors for the brands on the market will be the connected experience and the service applications provided to end customers. Today, car manufacturers are often squeezed between the GAFAM, which provides digital services, and mobile carriers (MNOs) delivering connectivity. Both parties seek to control the vehicles’ connectivity on the OEMs’ behalf and extract maximum revenues from the services by managing the relationship with the end-users.

Car manufacturers are therefore left with no other option than to become connectivity providers in their own rights in order to maintain their independence, profitability, and ability to innovate.

Connectivity means value as the network becomes an essential part of the service

Modern cars can simply not function and be maintained without cellular data connectivity, and drivers now expect embedded apps and services just like on their smartphones. Consumers are looking for global mobility solutions and buy an “experience” as much as the vehicle itself.

- Telematics services (predictive maintenance, Software update Over-The-Air, analytics)

- End-user services (infotainment, eCall, navigation)

- Third-party services (assistance, insurance, EV charging stations, …)

- New private LTE-5G industrial applications (assembly line testing, road tests, …)

- Full autonomous driving and safety applications

To enable these mission-critical features and secure new sources of revenues across geographies, a robust, secure, and reliable worldwide cellular connection is essential, on public as well as private networks.

However, global cellular data connectivity can be expensive and not easy to achieve. With the implementation of 5G networks, the amount of data generated by vehicles is expected to skyrocket from a few MBs/day for telematics and infotainment today, up to ~100GB/day to enable fully autonomous vehicles. This exponential data growth will bring connectivity costs to unprecedented heights for manufacturers. Mobile carriers being the ones controlling the network and setting airtime prices, OEMs need to find new ways to reinforce their negotiation power in order to continuously challenge them and secure competitive prices, worldwide.

Global connectivity becomes increasingly critical and a strategic asset across the automotive value chain. Whoever controls connectivity, will ultimately own the relationship with the final customers and unlock new sources of revenue created by the increasing use of apps within the vehicles. It’s therefore no surprise that Google, Apple Amazon, and other tech companies, as well as mobile carriers, demonstrate a great appetite to control the apps within the cars as well as the network to transfer the data in order to capture the larger share of the value. Unfortunately, manufacturers are slowly letting them enter their native ecosystem at their own risk of seeing somebody else monetizing the data collected and the access to the end-users.

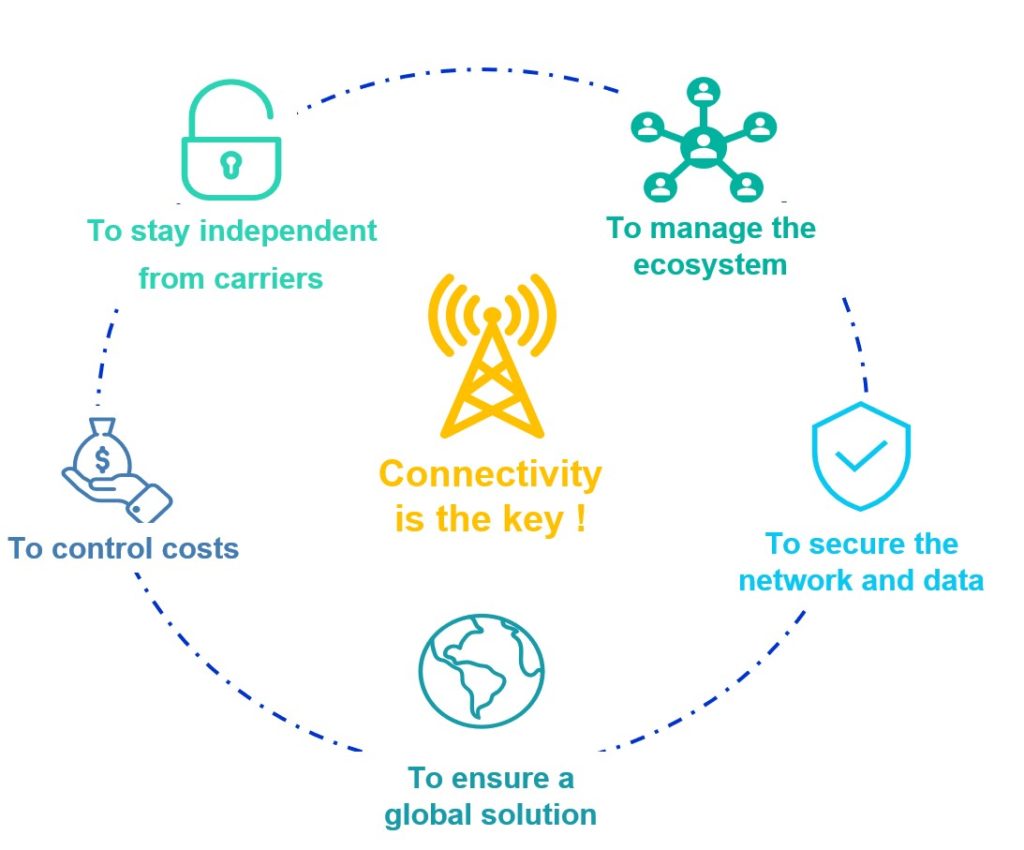

Just as they diversified into financial services to unlock additional revenues, maintain an end-to-end relationship with their customers, car manufacturers must now gain full control over their vehicles’ connectivity to prevent most of this value to go to GAFAM and/or mobile operators. Breaking free from their dependence on international mobile carriers and becoming autonomous connectivity service providers themselves seems to be the only viable way for OEMs to win over these powerful “coopetitors” in the long run.

Slowly but surely, because OEMs will be the next telcos

This won’t happen overnight though. Becoming connectivity service providers or “virtual” network operators is necessary for manufacturers not to be pushed on the side, but complex as they will need to build and manage their own telecom infrastructure and processes. Before flying on their own, OEMs can however partner with an independent enabler (like Transatel) and rely on its carrier-agnostic infrastructure while building their own connectivity platform over time.

Building and managing their own core network infrastructure will allow car manufacturers to be much more agile and flexible in the future. That approach brings significant benefits including:

- New services and business models : unlocking B2B and B2C additional revenues from connected services and end-user relationship management during the entire vehicle’s lifecycle.

- Global footprint and scalability: relying on a single core network avoid complex integrations with multiple operators across the world, ensure global coverage and consistent customer experience across geographies.

- Independence from mobile operators : OEMs could easily switch between networks at no cost and maximize their bargaining power to secure competitive airtime prices, anywhere in the world, by leveraging the enabler’s international network access and/or his own direct carrier agreements.

- Freedom to innovate and faster time to market with flexible configuration of advanced and fully tailored services.

- End-to-end secure connectivity: Automotive operating systems are also increasingly complex and interconnected with the vehicle’s immediate environment, which also means more vulnerable to cyber threats. Delegating connectivity management to third parties such as mobile carriers is a risk that OEMs may not be willing to take moving forward. Safety implications of fully autonomous vehicles will significantly increase manufacturers’ responsibility and accountability in case of accidents. Only owning and managing their own network infrastructure will enable OEMs to ensure end-to-end secure connectivity from the platform to the vehicle itself, using the SIM card and private APNs to effectively manage critical operations such as vehicle firmware updates.

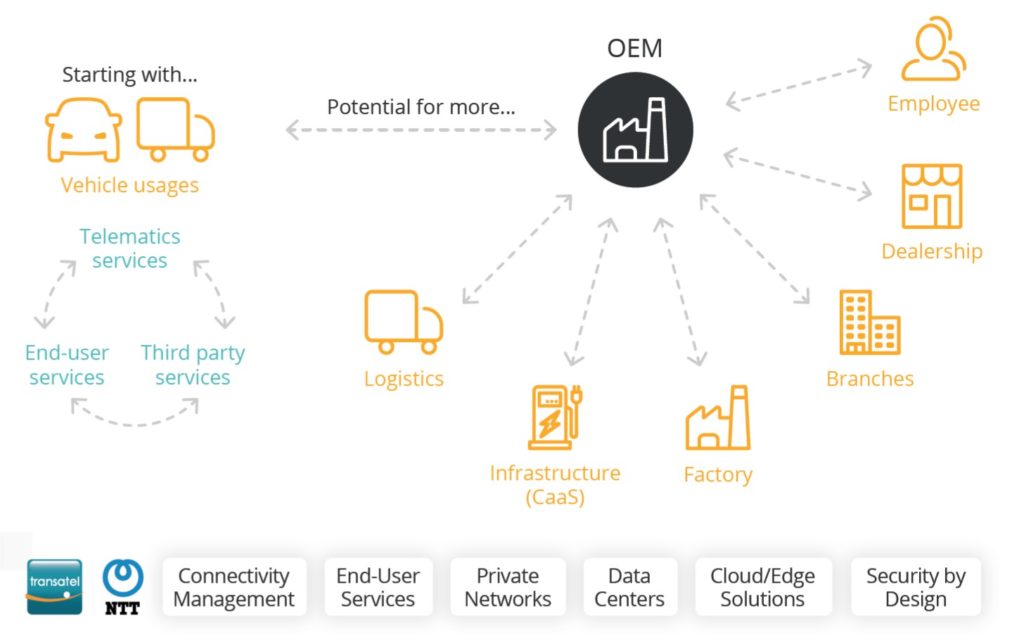

Vehicles’ connectivity management and beyond

As OEMs evolve into mobility service providers, their connectivity platform will not only enable the vehicle itself but also all their industrial, logistic, and commercial services. From private 5G-based smart manufacturing processes, road testing, and on-site updates to connected dealerships and EV charging stations, the ability to natively switch across public and private cellular networks will be a key competitive advantage through operational effectiveness and cost optimization.

For car manufacturers, gaining full control over the connectivity solution embedded in their vehicles is a strategic opportunity as much as a necessity. It will enable them to unleash innovation and maximize the potential of connected services, as well as the income these services will generate. Becoming connectivity service providers (or “virtual” network operators) is a new paradigm for the automotive industry, and a proven approach to successfully deploying connectivity solutions and unlocking new revenues, worldwide.

To learn more about how car OEMs can make that leap forward, download our white paper